refinance mortgage rates idaho: smart strategies for homeowners

Why rates move

In Idaho, refinance pricing reflects national bond markets, but local factors-competition among Boise and Treasure Valley lenders, rural appraisal spreads, and property tax escrows-can nudge quotes. Expect daily swings; a well-timed rate lock often matters more than chasing the absolute bottom.

Qualifying for the best offer

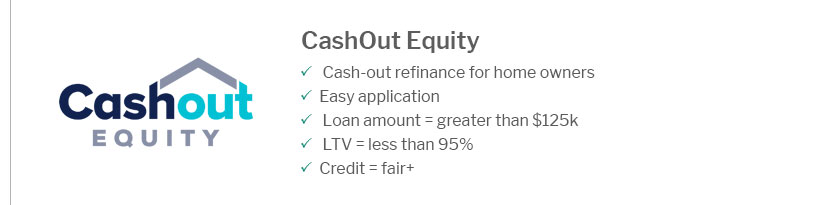

Lenders reward a lower LTV, strong credit, and stable income. Compare 15-year vs 30-year terms, and weigh points: paying 0.5–1.0 point can make sense if your break-even is under your expected move timeline.

Idaho-specific tips

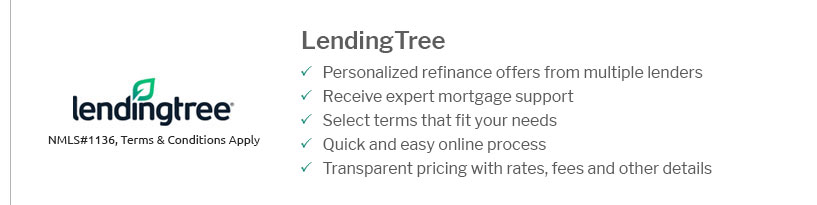

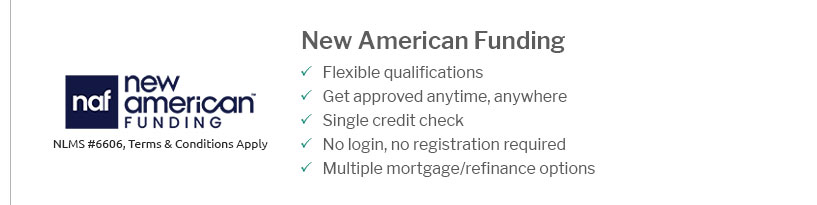

- Shop at least three quotes: a local credit union, a regional bank, and an online lender.

- Ask about conventional, FHA, or VA refi; rural properties may see tighter overlays.

- Verify appraisal turn times in fast-growing counties like Ada and Kootenai.

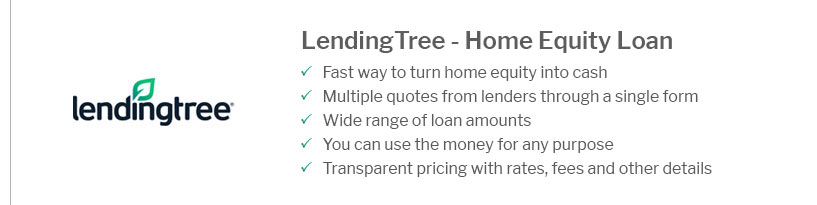

- Evaluate cash-out needs against wildfire or flood insurance costs near your area.

How to decide

- Calculate total fees and the breakeven months.

- Stress-test payment with a 0.25% higher rate.

- Lock with a float-down option if available.

- Keep reserves post-closing to protect eligibility and peace of mind.